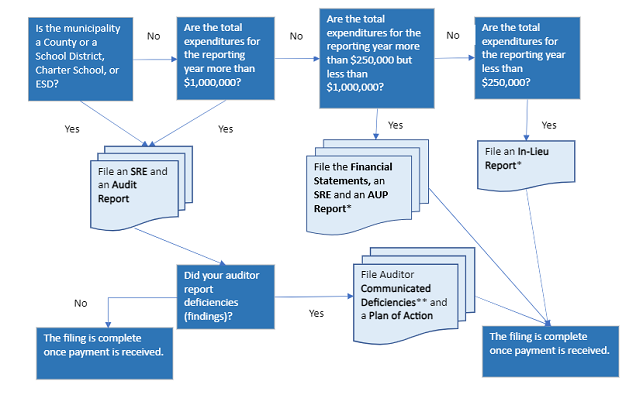

All municipalities must file an annual financial report. If the municipality’s

fiscal year ended on or before December 31, 2023, use the decision tree below to determine which type of report is required.

An SRE is the annual

Summary of Revenues and Expenditures form.

* To remain eligible for these reporting avenues, the municipality must 1) file timely and 2) maintain adequate fidelity or faithful performance bond coverage.

** Auditor communicated deficiencies are filed with the Secretary of State by the auditor. The plan of action is the responsibility of the municipal governing body.

If the municipality’s fiscal year ended on or after January 1, 2024, use the decision tree below to determine which type of report is required.

An SRE is the Summary of Revenues and Expenditures.

* To remain eligible for these reporting avenues, the municipality must 1) file timely and 2) maintain adequate fidelity or faithful performance bond coverage.

** Auditor communicated deficiencies are filed with the Secretary of State by the auditor. The plan of action is the responsibility of the municipal governing body.