2023-25 Legislatively Adopted Budget Expenditures

Source: Department of Administrative Services, Chief Financial Office

State Government

Oregon operates under a biennial budget, beginning July 1 of odd-numbered years and continuing for two years. Oregon law requires all state and local governments to balance their budgets. How does the state government’s budget work? The state receives money from a variety of sources which are grouped into funds. These funds are known as the General Fund, Lottery Fund, Other Funds and Federal Funds.

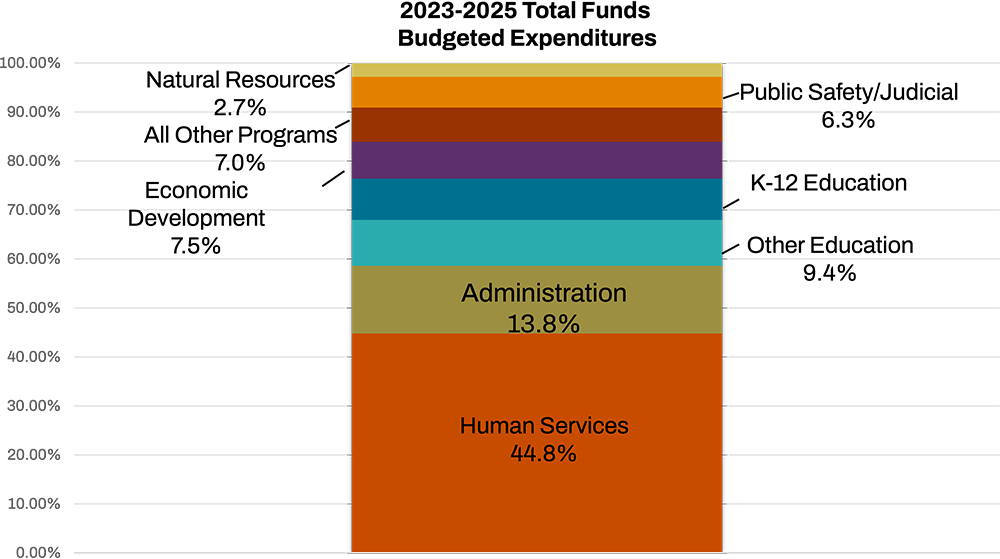

The total Legislatively Approved (LAB) Budget for the 2023–2025 biennium is $121.261 billion total funds. This represents a 3.6% decrease over the 2021–2023 LAB of $125.755 billion. The total budget for 2023–2025 biennium includes $31.874 billion General Funds, $1.617 billion Lottery Funds, $49.870 billion Other Funds and $37.901 billion Federal Funds.

General Fund

The 2023-25 Legislatively Adopted Budget included approximately $31.87 billion in General Fund expenditures – a 26.3% share of the total budget. General Fund appropriations increased by $4.74 billion (or 17.5%) over the prior biennial approved level. As of the June 2024 revenue forecast, the gross General Fund revenues for the 2023-2025 biennium are expected to reach $26.4 billion. This represents an increase of $534 million from the March 2024 forecast, and an increase of $1.2 billion relative to the Close of Session forecast (June 2023). The General Fund is largely made up of personal and corporate income taxes collected by the Oregon Department of Revenue. The personal income tax makes up the largest share of General Fund revenue. It accounts for 81.6% of projected gross revenue for the 2023–25 biennium. Other sources make up the remainder. The largest of these other revenue sources are corporate income tax, insurance tax, estate tax and revenues related to the liquor sales.

General Fund appropriations provide funding to agencies that do not generate revenues, receive federal funds, or generate sufficient other funds to support their approved programs. Agencies do not actually receive money from the General Fund. Instead, they expend against an appropriation from the General Fund that is established for general government purposes up to the amount approved in their budget bill. General Fund monies are a scarce resource that can be used for any public purpose; therefore, allocations of monies are competitive.

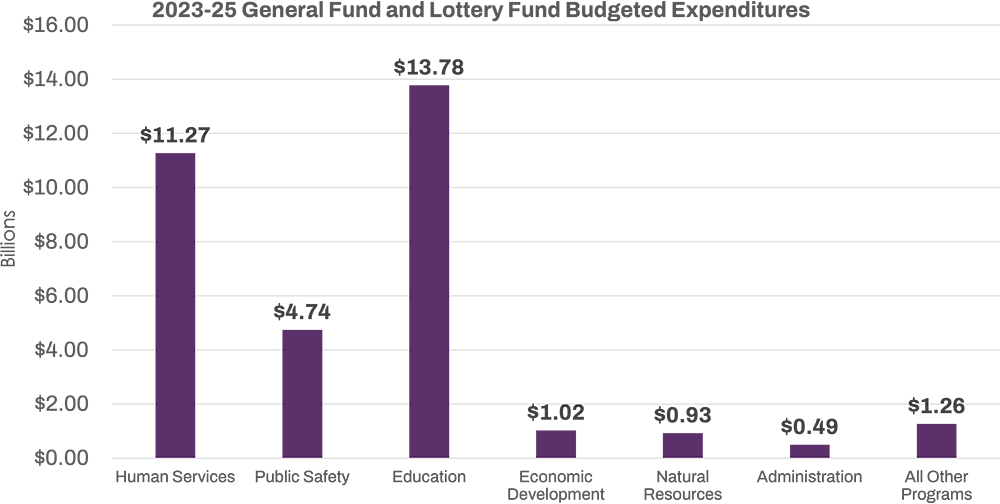

In 1990, voters approved Ballot Measure 5. This reduced local property tax rates, which reduced local revenue and shifted much of the responsibility for funding public schools to the state’s General Fund. The 2023-2025 Legislatively Adopted Budget had $9.46 billion (or 28.2%) of the General and Lottery Funds being appropriated to the State School Fund.

2023-25 Total Funds Budgeted Expenditures, Source: Department of Administrative Services, Chief Financial Office

2023-25 Total Funds Budgeted Expenditures, Source: Department of Administrative Services, Chief Financial Office Lottery Fund

The Lottery Fund is derived from the sale of lottery game tickets and from Video Lottery. After prizes and lottery expenses are paid, revenue flows to the Economic Development Fund. A portion of the Lottery Fund is constitutionally dedicated to be spent in specific ways. The remainder is distributed at the discretion of the Legislature for job creation, economic development, public education, and Oregon’s parks, beaches, watersheds, and native fish and wildlife.

The 2023-2025 Legislatively Adopted Budget includes $1.62 billion of expenditures from the Lottery -Fund (or 1.3% of the total budget). The Lottery Fund distributes certain portions through three constitutionally dedicated transfers. These dedicated transfers go to the Education Stability Fund (18% of net lottery proceeds), Parks and Natural Resources Fund (15% of net lottery proceeds) and Veterans’ Services Fund (1.5% of net lottery proceeds). Sports Betting proceeds are transferred to the Employer Incentive Fund. The second categorical use of lottery resources finances debt service costs associated with lottery revenue bonds, which totaled $344.3 million for outstanding bonds and estimated payments on lottery bonds authorized to be issued during the 2023-2025 biennium. The remainder is distributed to the State School Fund and other projects. The remainder was distributed to the State School Fund, Oregon Business Development Department, and the Office of the Governor for Regional Solution positions. Overall, roughly 49.68% of the Lottery Fund was distributed to education.

Other Funds

The 2023-2025 Legislatively Adopted Budget included $49.87 billion in Other Funds (or 41.1% of the total funds). This represents a decrease of $3.26 billion (or 6%) from the 2021-2023 approved budget. Other Funds revenue generally refers to monies agencies collect in return for services. Legislative actions may allow an agency to levy taxes, provide services for a fee, license individuals, or otherwise earn revenues to pay for programs. These Other Funds are often separate and distinct from monies collected for general government purposes (General Fund), and they may be based on statutory language, federal mandate, legal requirements, or for specific business reasons. Some funds are “dedicated”— the income and disbursements are limited by the state’s constitution or by another law (for example, the Highway Fund). Since Other Funds are typically for a specific program, competition for these monies is limited.

2023-25 General Fund and Lottery Funds Expenditures, Source: Department of Administrative Services, Chief Financial Office

2023-25 General Fund and Lottery Funds Expenditures, Source: Department of Administrative Services, Chief Financial Office Federal Funds

The 2023-2025 Legislatively Adopted Budget included $37.90 billion in Federal Funds, a decrease of $6.15 billion (or 14%) from the 2021-2023 legislatively approved Federal Funds level. This decrease is primarily due to the continued phase out of major investments of pandemic-related assistance approved in 2020 and early 2021. Federal Funds are monies received from the federal government through entitlement programs, grants and aid awarded to various state agencies. Federal Funds Nonlimited can include payments made directly to beneficiaries of federally funded unemployment insurance benefits, rental assistance payments, and supplemental nutrition assistance.

State Budget Process

Oregon state agencies develop biennial budgets according to instructions provided by the Department of Administrative Services, Chief Financial Office. This budget development process begins in even- numbered years,well before the Legislative Assembly convenes in January of odd-numbered years. Agencies are required to prepare and submit their budget requests to the Chief Financial Office. These requests consist of narrative descriptions of agency programs, completed budgetary forms and reports from the Oregon Budget Information and Tracking System (ORBITS). An agency budget request serves as a conduit to the Governor and the Legislature that identifies the agency’s needs and priorities.

Agencies begin by building a Current Service Level (CSL) budget, the amount of money needed in the upcoming biennium to continue existing authorized programs into the next biennium. An agency may request additions to their CSL budget through policy option packages, which describe the purpose and the amount needed. Agencies also must identify program reductions and key performance measure targets. Agencies began working on their 2025-2027 budget requests in March 2024 and submitted their completed requests by September 2024. An agency’s budget provides an outline of what an agency does, what it costs and how many people are involved.

After analysis by the Governor’s Office and the Chief Financial Office, the governor aligns their priorities with the agencies’ requests, resulting in the Governor’s Recommended Budget. The Governor has a legal obligation to submit a balanced budget for the entire state government; therefore, the Governor’s Recommended Budget includes the proposed budgets for the Legislative Assembly and the Judicial Department. However, because of separation of power principles, the Governor’s budget recommendations are advisory only for the other two branches. The Governor presents the Governor’s Recommended Budget to the Legislative Assembly when it convenes in January of odd-numbered years.

When the Legislative Assembly is in session, a subcommittee of the Joint Committee on Ways and Means considers each agency’s budget. At the budget hearings, an agency presents its budget request. Agency, Legislative Fiscal Office and the Chief Financial Office staff are at the hearing and answer questions asked by committee members. The public may attend the hearings and request an opportunity to testify. At the end of an agency’s budget hearings, the agency’s budget goes to the full Joint Committee on Ways and Means for a vote and then on to the full House and Senate for a vote. The agency’s budget may be amended at any point in this process, although changes typically occur during the subcommittee hearings. After passage by both chambers, an agency’s budget becomes its LAB for the biennium, and it goes into effect July 1 of odd-numbered years. If the Legislature makes changes to the adopted budget in legislative sessions or through the Emergency Board, it becomes known as the Legislatively Approved Budget.

Kicker Provision

The Oregon Constitution requires the governor to provide an estimate of biennial General Fund revenues. In 1979, the Legislature placed a condition on those revenue estimates that required excess funds be “kicked back” to taxpayers if actual revenues exceeded estimated revenues by 2% or more of the close-of-session estimate.

For revenues from corporate income and excise taxes, the provision had required that the excess be returned to taxpayers who paid corporate income and excise taxes. However, this provision was amended in November 2012 by the citizen initiative process. Ballot Measure 85 requires that this excess be retained in the General Fund to provide additional funding for public education of kindergarten through 12th grade. This measure is applicable to biennial estimates on or after July 1, 2013.

For General Fund revenues from all other sources where the actual revenues exceed the estimated revenues by 2% or more, the excess is “kicked back” to taxpayers who paid personal income tax. Ballot Measure 85 did not affect this provision. These taxpayers receive the refund as a tax credit in the following year’s tax return. The refund is an identical proportion of each taxpayer’s personal income tax liability for the prior year. Following the 2021-23 biennium, the personal income tax kicker reached a new high dollar amount of $5.5 billion, which means actual revenue in the close of the biennium on June 30, 2023 exceeded the projected estimated in May of 2021 by $5.5 billion.

Rainy Day Fund and Education Stability Fund

Established in 2007, the Oregon Rainy Day Fund is essentially a savings account for state government. Withdrawals can be made, after a three-fifths vote of approval by the Legislature, if there is a decline in the General Fund for the current or subsequent biennium budgets, there is a prolonged employment decline or the Governor declares an emergency. The Education Stability Fund (ESF) was created through a constitutional amendment approved by voters in 2002. The ESF receives 18% of net lottery proceeds deposited on a quarterly basis. The ESF has similar requirements as the Rainy Day Fund. During the 2019–2021 biennium, $400 million was withdrawn from the ESF to balance the budget.

The 2023-2025 ending balance for the Rainy Day Fund is projected to be $1.872 billion. The 2023-25 ending balance for the Education Stability Fund is projected to be $1.007 billion.

State Spending Limit

The state spending limit was first enacted by the 1979 Legislative Assembly. It limited the growth of General Fund appropriations to the growth of personal income in Oregon. The 2001 Legislative Assembly replaced this spending limit with one tying appropriations for a biennium to personal income for that biennium. The appropriations subject to this limit may not exceed 8% of projected personal income for the same biennium. The limit may be exceeded if the Governor declares an emergency and three-fifths of the members of both chambers vote to exceed it.